India ICC has adopted SPAN® (Standard Portfolio Analysis of Risk) methodology or any other system for the purpose of real time initial margin computation. The SPAN methodology helps to provide an integrated view of the risk involved in the portfolio of each individual client. The initial margin shall be deducted upfront on an on-line real-time basis from the available liquid assets deposited by the Clearing Member with India ICC.

The margins levied to members shall be levied and collected in USD.

Initial Margin

India ICC has adopted SPAN® (Standard Portfolio Analysis of Risk) methodology or any other system for the purpose of real time initial margin computation. The SPAN methodology helps to provide an integrated view of the risk involved in the portfolio of each individual client. The initial margin shall be deducted upfront on an on-line real-time basis from the available liquid assets deposited by the Clearing Member with India ICC.

Initial Margin requirement shall be based on a worst scenario loss of a portfolio of an individual client comprising of his positions in the options and futures contracts across different underlying and maturities for various scenarios of price and volatility changes. The initial margin requirements shall be set to provide coverage of at least a 99% single-tailed confidence interval of the estimated distribution of future exposure over a one day time horizon.

The initial margin requirement is netted at the client level and calculated on gross basis at the Trading/Clearing Member level. The initial margin requirement for the proprietary position of Trading / Clearing Member would also be on net basis..

Computation of Initial Margin - Overall Portfolio Margin Requirement

The computation of worst scenario loss has two stages. The first is the valuation of the portfolio under the various scenarios of price changes. At the second stage, these scenario contract values would be applied to the actual portfolio positions to compute the portfolio values and the initial margin. The scenario contract values shall be updated at the start of the business day, then every 1.5 hours and finally at the end of the business day. The latest available scenario contract values would be applied to member/client portfolios on a real time basis.

The total margin requirements for a member, for a portfolio of futures and options contract are computed as follows:

i. SPAN will add up the Scanning Risk Charges and the Intra-commodity Spread Charges.

ii. It will compare this figure (as per i above) to the Short Option Minimum charge

iii. SPAN will select the larger of the two values between (i) and (ii)

iv. Total SPAN Margin requirement is equal to SPAN Risk Requirement (as per iii above), less the 'net option value', which is mark to market value of difference in long option positions and short option positions.

Risk parameters, generated, based on the updated details shall be available on the India INX website.

Price Scan Range

Price Scan Range (PSR) is a type of SPAN parameters used for calculating margin requirement in SPAN® framework. PSR amount shows the minimum margin requirement when you hold 1 short/long position of Futures contract, provided, however, when you hold positions across multiple contract months, and/or combinations of Futures and Option contracts, minimum margin requirement can be increased/decreased.

The price scan range is the probable price change over a one-day period and is referred as standard deviation sigma.

The standard deviation (volatility estimate) shall be computed using the Exponentially Weighted Moving Average Method (EWMA).

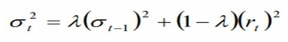

The price scan range (sigma value) and volatility scan range are specified. The estimate at the end of time period t (σt) shall be estimated using the volatility estimate at the end of the previous time period. i.e. as at the end of t-1 time period (σt-1), and the return (rt) observed in the futures market during the time period t.

The volatility estimated at the end of the day's trading would be used in calculating the initial margin calls at the end of the same day.

The formula shall be as under:

Where

- λ is a parameter which determines how rapidly volatility estimates changes. The value of λ is currently fixed at 0.94.

- σ (sigma) means the standard deviation of daily returns in the futures market.

- The "return" is defined as the logarithmic return: rt = ln (St/St-1) where St is the price at time t.

Volatility Scan Range

The Volatility Scan is the amount by which the implied volatility is changed in each risk array scenario. Just as there is a set price scan range, there is a set Volatility scan range.

SPAN calculates the probable premium value at each price scan point for volatility up and volatility down scenario. It then compares this probable premium value to the theoretical premium value (based on last closing value of the underlying) to determine profit or loss. The sigma σ would be the standard deviation σ of daily logarithmic (ln) returns of futures price.

The price scan range and volatility scan range ("VSR") for generating the scenarios would be as below or such other percentage as may be specified by INDIA ICC from time to time.

The current PSR & VSR values for the various product types are given as below:

| Index Futures and Options |

Three standard deviation (3 sigma) or such

other price scan range for the underlying as may be specified

from time to time. |

4% or such other percentage as may be specified from time to time |

| Single Stock Futures and Options |

Three and a half standard deviation (3.5 sigma) or such other

price scan range for the underlying as may be specified from

time to time. |

10% or such other percentage as may be specified from time to time |

|---|

| Commodity Futures and Options |

Three standard deviation (3 sigma) or such other price scan

range for the underlying as may be specified from time to time. |

4% or such other percentage as may be specified from time to time |

|---|

| Currency Futures and Options |

Three and a half standard deviation (3.5 sigma) or such other

price scan range for the underlying as may be specified from

time to time. |

3% or such other percentage as may be specified from time to time |

|---|

Calendar Spread Margins

As SPAN scans futures prices within a single underlying instrument, it assumes that price moves correlate perfectly across contract months. Since price moves across contract months do not generally exhibit perfect correlation, SPAN adds a Calendar Spread Charge (also called the Inter-month Spread Charge) to the Scanning Risk Charge associated with each futures and options contract. To put it in a different way, the Calendar Spread Charge covers the calendar (inter-month etc.) basis risk that may exist for portfolios containing futures and options with different expirations.

A futures position at one expiry month which is hedged by an offsetting position at a different maturity would be treated as a calendar spread. The benefit for a calendar spread would continue till expiry of the near month contract. The calendar spread margin shall be deducted from the liquid net worth of the clearing member on an online, real time basis.

For each futures and options contract, SPAN identifies the delta associated with each futures and option position, for a contract month. It then forms spreads using these deltas across contract months. For each spread formed, SPAN assesses a specific charge per spread which constitutes the Calendar Spread Charge.

The margin for options calendar spread would be the same as specified for futures calendar spread. The margin would be calculated on the basis of delta Δ of the portfolio in each month. A portfolio consisting of a near month option with a delta Δ of 100 and a far month option with a delta Δ of –100 would bear a spread charge equal to the spread charge for a portfolio which is long 100 near month futures and short 100 far month futures.

The calendar spread margins for various product types are given as below:

| Product Type |

Calendar Spread Charge |

| Index Futures and Options |

0.5%(number of spread months) subject to a minimum margin of 1% and a maximum margin of 2% |

| Single Stock Futures and Options |

0.5%(number of spread months) subject to a minimum margin 1% and a maximum margin of 3% |

|---|

| Commodity Futures and Options |

0.5%(number of spread months) subject to a minimum margin of 1% and a maximum margin of 2% |

|---|

| Currency Futures and Options |

0.25%(number of spread months) subject to a minimum margin 1% and a maximum margin of 2% |

|---|

Inter – Commodity Spread Margin benefits

The inter-commodity spread margin benefits which would be applicable to contracts traded on the India International Exchange (IFSC) Limited:

| Leg Delta A |

Leg A Contract Code |

Leg A |

Leg Delta B |

Leg B Contract Code |

Leg B |

Credit Rate |

| 1 |

Sensex |

Sensex |

3 |

Sensex 50 |

Sensex 50 |

75.00% |

| 1 |

Gold |

Gold |

2 |

Silver |

Silver |

55.00% |

| 4 |

INRUSD |

INRUSD |

7 |

USDINR |

USDINR |

90.00% |

Short Option Margin

Deep-out-of-the-money short options may show zero or minimal Scan Risk given the price and volatility moves in the 16 market scenarios, yet still present risk in the event that these options move closer-to-the-money or in-the-money, thereby generating potentially large losses. Hence a Short Option Minimum Margin is applied to each product to account for this potential exposure. The Short Option Minimum Margin is calculated on the Notional Value of all short options.

SPAN assesses a minimum margin for each short option position in the portfolio called the Short Option Minimum charge, which is set by the India ICC. The Short Option Minimum charge serves as a minimum charge towards margin requirements for each short position in an option contract.

For example, suppose that the Short Option Minimum charge is 50 dollar per short position. A portfolio containing 20 short options will have a margin requirement of at least 1,000 dollars, even if the scanning risk charge plus the inter-month spread charge on the position is 500 dollars only.

Exposure Margin

Exposure margin covers the expected loss in situations that go beyond those envisaged in the 99% value at risk estimates used in the VaR margin. It is on the mark to market value of the gross open positions or as may be specified from time to time and shall be deducted upfront from the available liquid assets of the clearing member on an on line, real time basis.

The exposure margin shall be deducted from the liquid assets of the clearing member on an online, real time basis.

Enforcement and Collection of Margins

Aforesaid margins are computed at a client level portfolio and grossed across all clients (including proprietary positions of member) at the member level margins are collected/adjusted upfront from the liquid assets of the Clearing Members on an on-line real time basis.

Members are required to collect initial margins, exposure margins and premium from their client/constituents on an upfront basis. It is mandatory for all members to report details of such margins collected to INDIA ICC/INDIA INX. The procedure for reporting of margins is detailed separately.

Client Margin Reporting

Clearing Members shall report margin collected from their Trading Members (for proprietary account positions of Trading Members) and from their Custodial Participant (CP) Clients respectively and Trading Members shall report margin collected from their Clients. This reporting shall be through GUI based Margin File upload utility.

The reporting of collected margins shall be for files pertaining to the end of each business day i.e. session II. The reporting should be done before 23:50 hours of T+5 day i.e. the 5th working day from the T day.

For this purpose, Members are required to download the following end of day margin files from the Extranet:

INX_MGTM_ < Member Code >_< YYYYMMDD >_2.CSV

INX_MGCM_< Member Code >_< YYYYMMDD >_2.CSV

The said files are to be opened using the notepad and the filled amount of total applicable margins are required to be uploaded through the Extranet as per the format given below:

INX_MGTM < Member Code >_2.Mnn

INX_MGCM < Member Code >_2.Mnn

Members are required to note that non-reporting/short collection/non-collection of margins will attract fines/penalties as prescribed by INDIA ICC in their circulars from time to time

Imposition of Additional Margins

As a risk containment measure, INDIA ICC may require clearing members to make payment of additional margins as may be decided from time to time. This shall be in addition to the initial margin and exposure margin, which are or may have been imposed from time to time.

Mode of payment of Margin

Clearing members shall provide for margin in any one or more of the eligible collateral modes as specified by the India ICC. The margins shall be collected/adjusted from the liquid assets of the member on a real time basis.

Payment of Margins

The initial margin and exposure margins shall be payable upfront by the clearing members. Initial margins and exposure margins are required to be collected by the member from the client/ constituent on an upfront basis. It is mandatory for all clearing/ trading members to report details of such margins collected to India ICC.

Collateral Limit for Trading Members

Clearing members clearing and settling for other trading members - shall specify the maximum collateral limit permitted for each trading member. Such limits may be set up by the clearing member, up to the time specified by India INX Exchange/ India ICC through the facility as may be provided by INDIA INX/ INDIA ICC from time to time. The aggregate limit set up across all trading members, clearing and settling through such clearing member, shall at no point of time exceed the effective deposit of the clearing member with INDIA ICC less minimum liquid net worth.

Crystallised Loss Margin

India ICC blocks real time margin for open positions arising out of trades in all the products. India ICC shall collect the intra-day crystallised loss margin (CLM) from the free collateral on an online real-time basis only for those transactions which are subject to upfront margining. CLM shall be calculated and collected only when a member takes an offsetting position. An offsetting position requires assuming an opposite position in regards to the original outstanding position. For the purpose of calculating Crystallised loss/ profit, such offset trades would be only to the extent of the existing open positions. The CLM will be released at the end of the day when Mark to Market ("MTM") Margin obligation is levied. The crystallised gain may be used to offset subsequent crystallised losses at the client level, to the extent of such client level crystallised losses. If the crystallised gains exceed the crystallised losses, no benefit shall be accrued towards the available collateral. The Crystallised Loss will be set off against Crystallised profit only on the Client Level. On the Clearing Member/ Trading Member Level, the Crystallised Profit shall be ignored. The crystallised loss margin will be added in total margin requirements and in case the total margin requirements exceeds the threshold of margin percentage applicable for risk reduction mode (RRM) then the member shall be put in RRM.

Risk Reduction Mode

All Trading Members are put in Risk Reduction Mode (RRM), when collateral / trading limit utilization of member reaches 90%. Following features shall be applicable during Risk Reduction Mode:

- All unexecuted orders shall be cancelled.

- Fresh orders which reduce open position shall be accepted

- Fresh orders which increase open position shall be checked for margin sufficiency.

- If sufficient margin is not available, such orders shall be rejected.

- Fresh orders can be placed for immediate or cancel (IOC) only.

Assignment Margin

Assignment Margin shall be levied on assigned positions of the clearing members towards exercise settlement obligations for option contracts. For option positions exercised, the seller shall be levied assignment margins which shall be 100% of the net exercise settlement value payable by a clearing member, till the completion of pay-in towards exercise settlement. Assignment margins shall be computed as net of assignment settlement and futures final settlement.